Calculate hourly rate for semi monthly payroll

If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Federal income tax rates range from 10 up to a.

The Pros And Cons Biweekly Vs Semimonthly Payroll

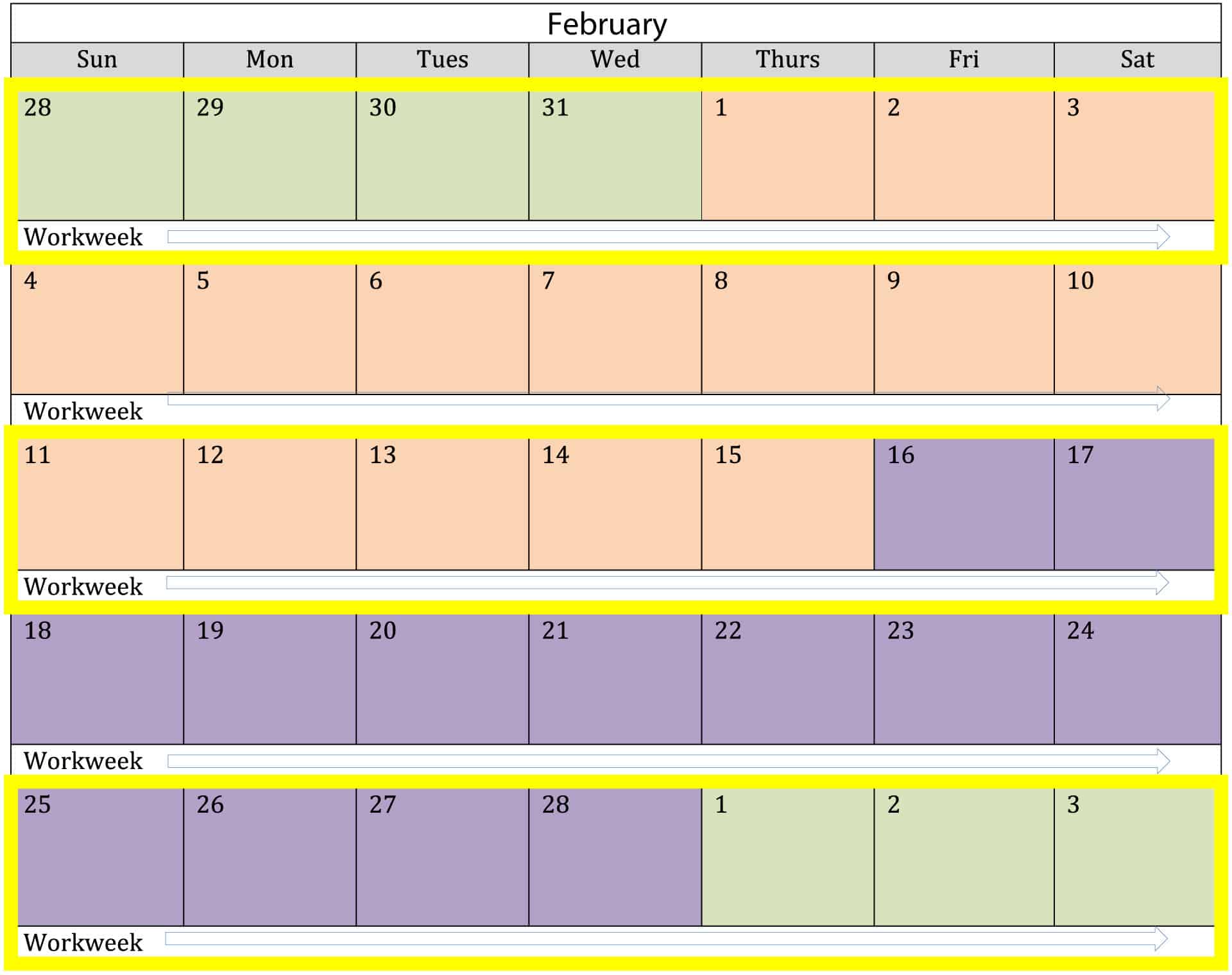

Total the Hours Worked for the Week 3.

. Calculates gross wages -- including overtime based on your choice of 8 or 10 hours per day 40 hours per week with carryover OT calculation or 96 hours for the semi-monthly pay period. This method requires that you determine her regular hourly pay rate. In a pay period with 16 days the daily rate would be 125.

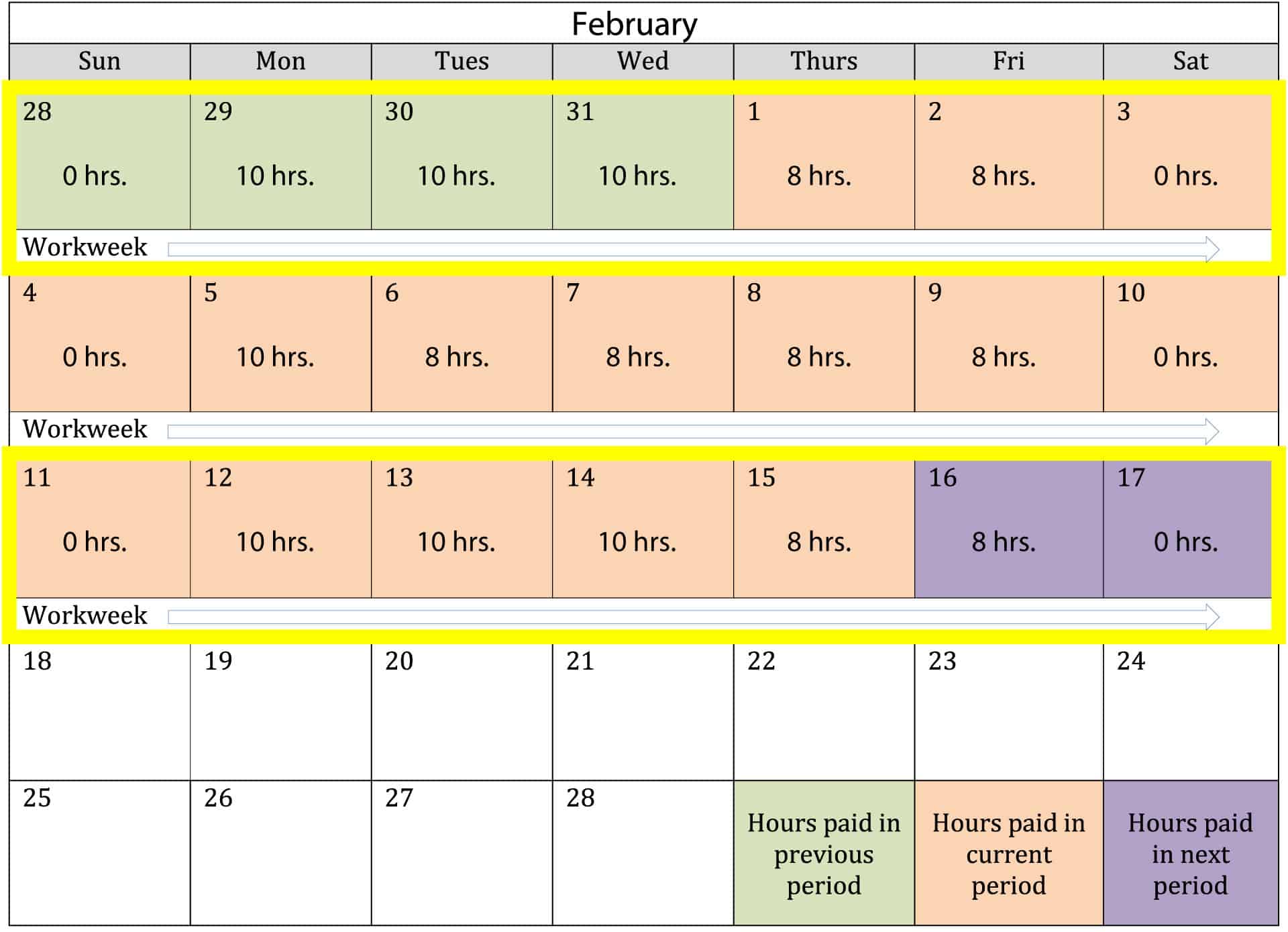

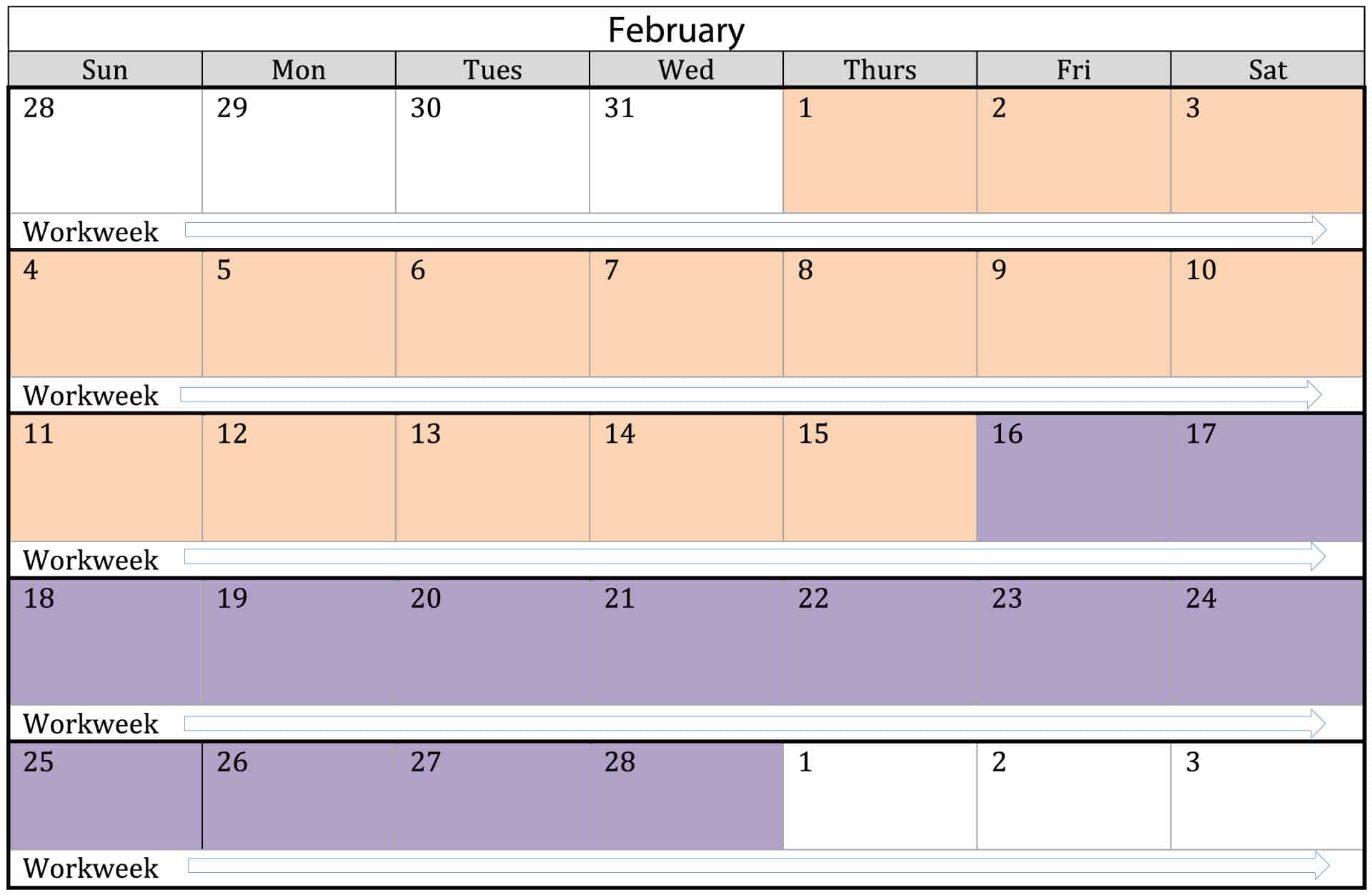

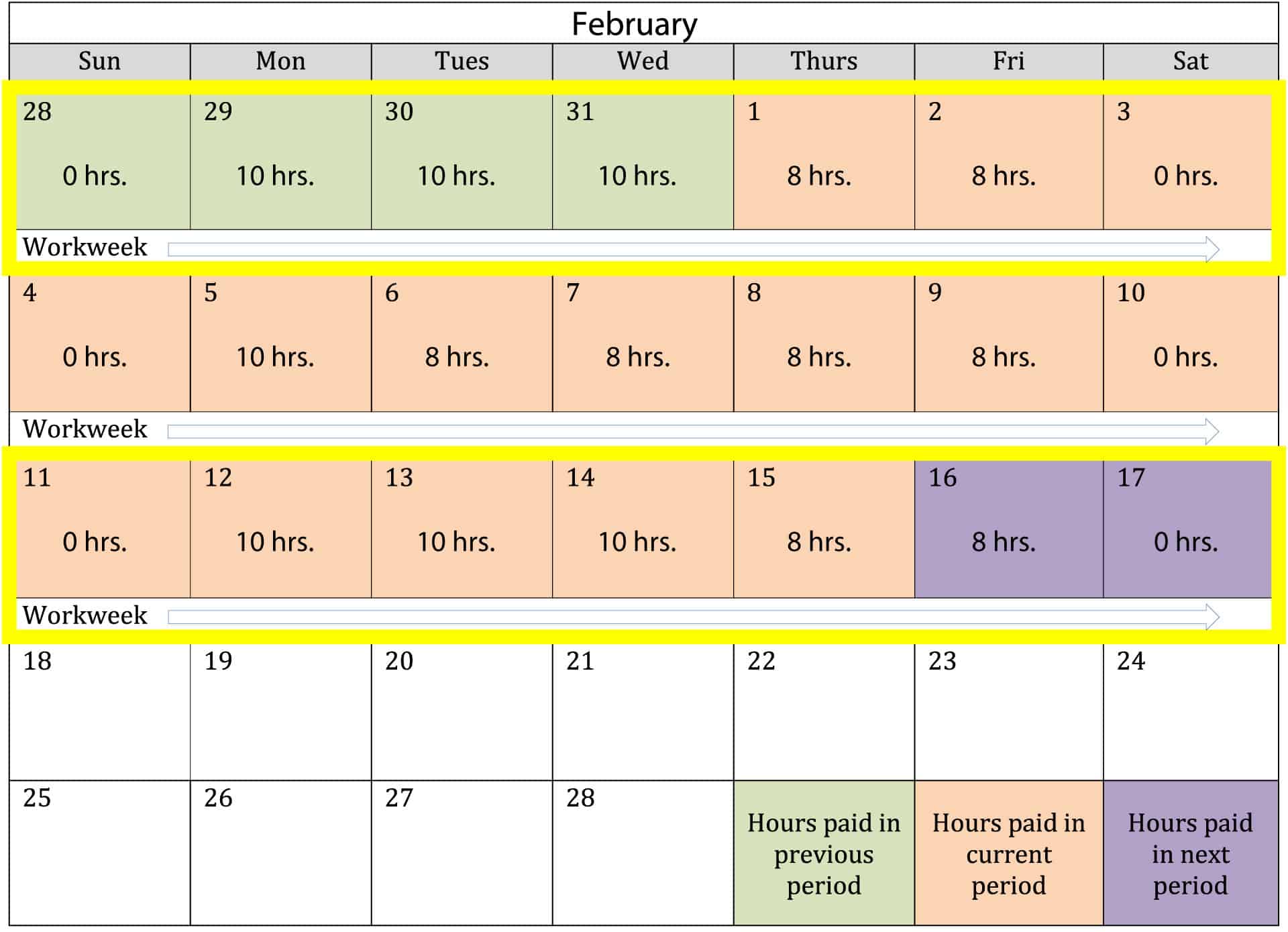

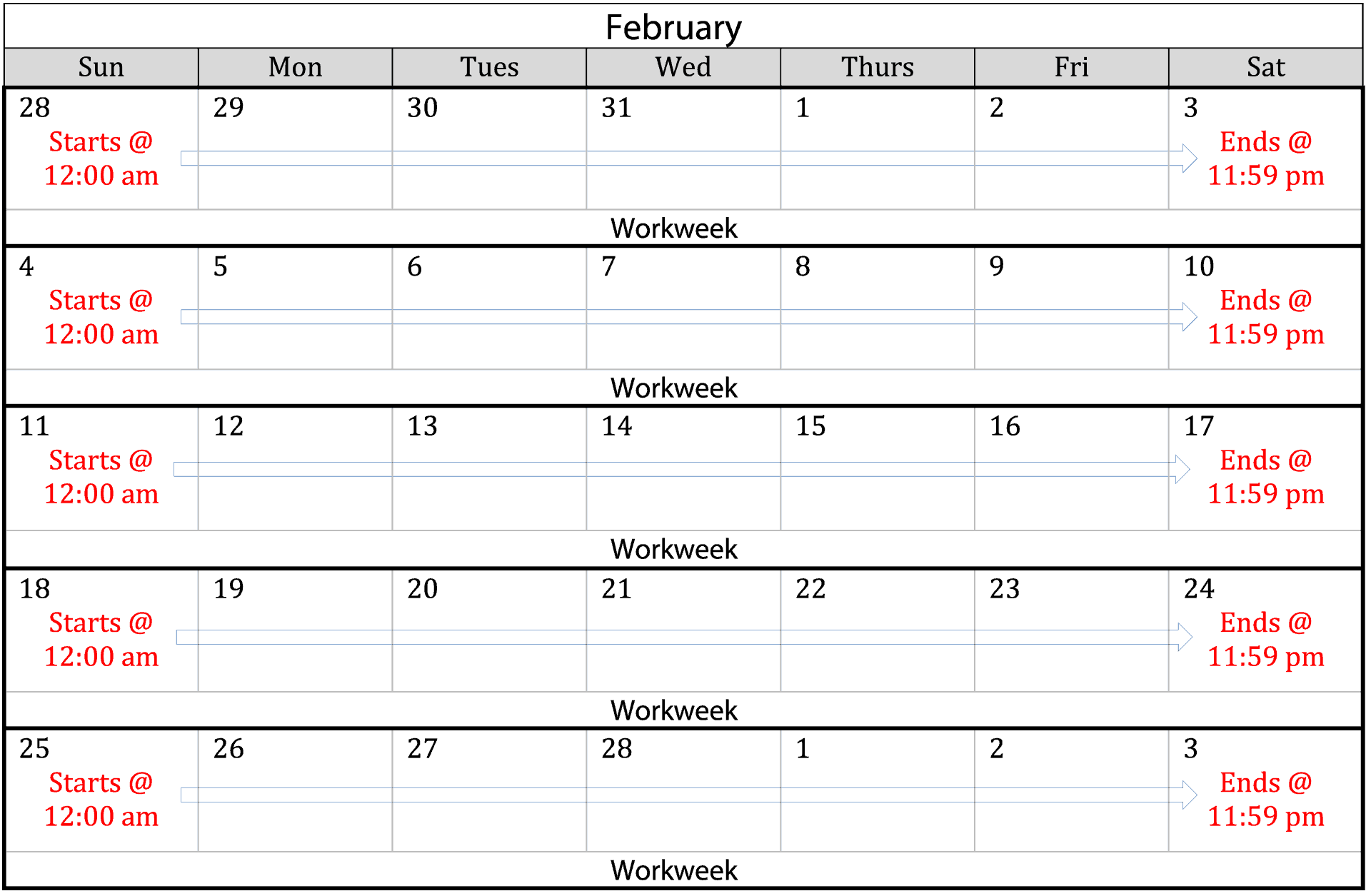

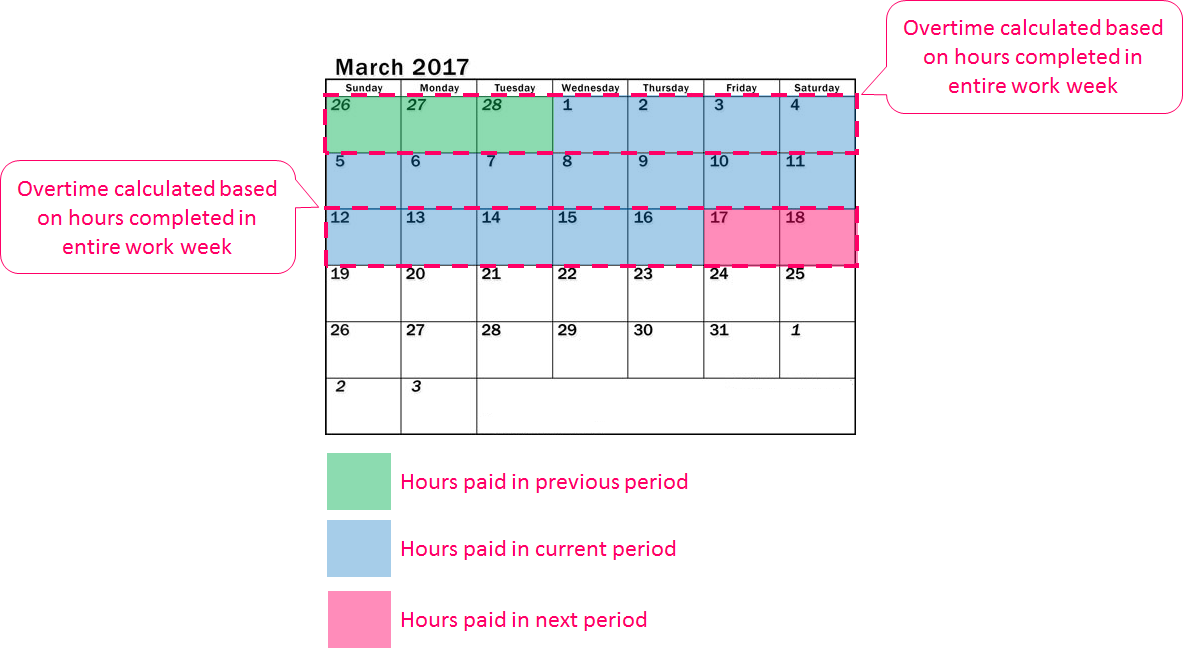

Separate into Workweeks 2. Payroll Seamlessly Integrates With QuickBooks Online. Calculating Overtime Below is an example of how an employer would calculate overtime hours in a semi-monthly pay period.

To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12. For the cashier in our example at the hourly wage. Paid a flat rate.

Then divide the result you get by the total number of paid weeks. Ad Process Payroll Faster Easier With ADP Payroll. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. For both of these reasons you should be aware of your employees daily rate. Due to the nature of hourly wages the amount paid is variable.

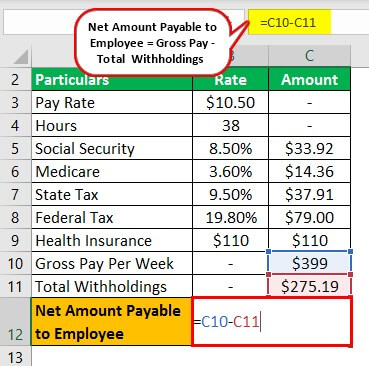

Calculate and Divide Multiply hours worked by your hourly rate. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager.

Multiply hourly rate of basic pay by 80 hours. Content updated daily for semi monthly payroll calculator. A semi-monthly gross pay of 2000 equates to a daily rate of 13333 in a pay period with 15 days.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. 1500 per hour x 40 600 x 52 31200 a year. How to calculate the.

The hourly to salary is able to convert your hourly rate to weekly monthly quarterly or yearly. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. You can calculate this by dividing the 2080workdayss by the 24 semi-monthly payrolls.

Semi-monthly pay is another option for employers. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll. If you or your employee made.

The semi-monthly time card calculator is also available multiple hourly rates and weighted overtime and you can print out a blank free semi-monthly timesheet template and. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you. Ad Looking for semi monthly payroll calculator.

This salary calculator assumes the hourly and daily salary inputs to be. As a result of this salaried employees are paid for 8667 hours each semi-monthly pay period. Divide her salary for the pay period by the number of hours salary is based on.

Federal Paycheck Quick Facts. Starting salary for a GS-12 employee is 6829900 per year at Step 1 with a maximum possible base pay of 8879200 per. Payroll Seamlessly Integrates With QuickBooks Online.

The adjusted annual salary can be calculated as. Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee.

Ad Payroll So Easy You Can Set It Up Run It Yourself. With a semi-monthly pay. A semi-monthly gross pay of 2000 equates to a daily rate of 13333 in a pay period with 15 days.

In Workweek 1 we can see that Jack Black worked a total 46 hours. Although its admittedly less common with just 198 of businesses opting for this payment frequency. A semi-monthly gross pay of 2000 equates to a daily rate of 13333 in a pay.

How to Calculate a Semi-Monthly Paid Employees Daily Rate How to Calculate Overtime for a Semi-monthly Payroll 1. For example if an employee earns 1500 per week the individuals annual. Get Started With ADP Payroll.

To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having. For the cashier in our example at the hourly wage.

Multiply 188 by a stated wage of 20 and you get 3760. Subtract the number of calendar days in the pay period from the total gross semi-monthly. If all you have is the annual gross salary paid semi-monthly divide this value by 2080 the average number of work hours in any calendar year.

![]()

Download Free Bi Weekly Timesheet Template Replicon

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Elaws Flsa Overtime Calculator Advisor

4 Ways To Calculate Annual Salary Wikihow

What Payroll Schedule Makes Sense For Your Business Guide When I Work

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Difference Between Bi Weekly And Semi Monthly Difference Between

How To Calculate Pay Using The State Formula Rate Mit Human Resources

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Semi Monthly Pay Period Timesheet Mobile

What Is A Pay Period Free 2022 Pay Period Calendars

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Payroll Formula Step By Step Calculation With Examples

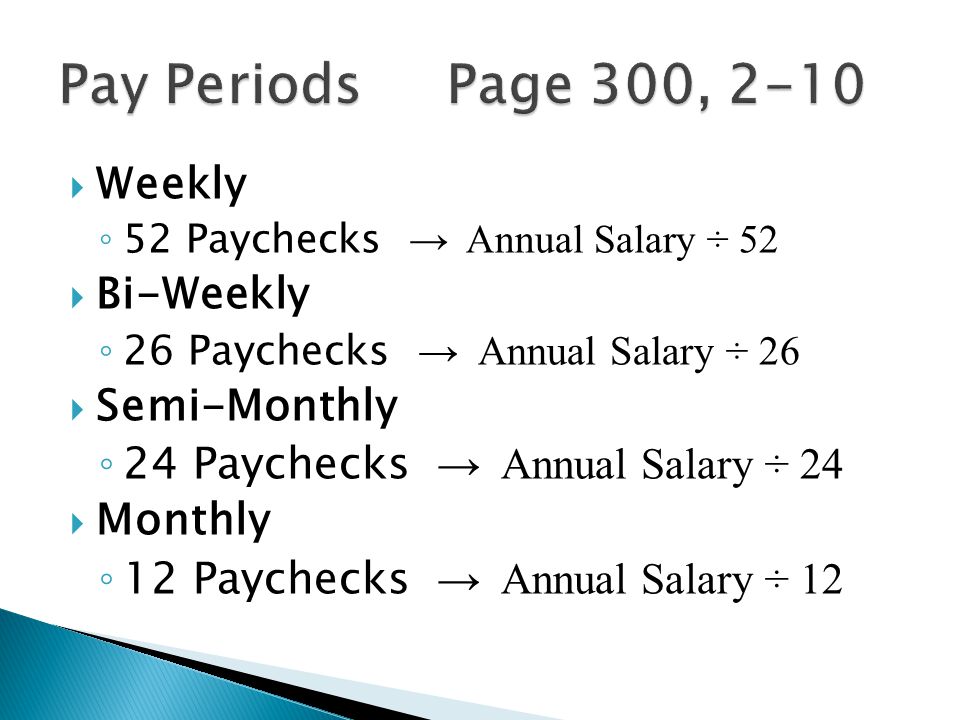

Salaries Ppt Video Online Download

How To Set Up Pay Periods To Work With Pay Dates Ontheclock